Most people think that they just need to make a little bit more money.

“If I made just $20,000 more each year, I’d have enough money.”

This is a common way of thinking that has been shown repeatedly in study after study. We all, whether you make $60,000 or $120,000, think that we are just on the cusp of making the amount of money we need to be happy in life.

The problem, of course, is that it doesn’t work like that. It’s not what you make that is the problem, it’s what you spend.

Conspicuous Consumption

It’s unfortunate that for so many people, their personal self-worth is tied up in what they can consume. The house they have, the car they drive, the furniture they sit on to watch the TV they own. Internally, it makes people feel successful to accumulate material goods. Externally, it’s their way of showing other people they have “made it.”

This form of consumption is a path that leads you to always asking “what’s the next nicest things I can buy?”

Consequently, this is why a lot of people think they just need a little bit more money to have the life they want. They see that car that is a bit nicer than theirs. They know they can’t afford a brand new Tesla, but maybe they can swing a car payment for an entry-level Lexus or a new truck.

It’s a way we’ve been trained to think and consume. But it’s not healthy, and it’s a path to being less content and less financially secure.

Your Savings Rate Matters, Not Your Income

As every personal finance expert will tell you, your savings rate matters. The percentage of your income that you can save will be the largest factor in your ability to be financially independent.

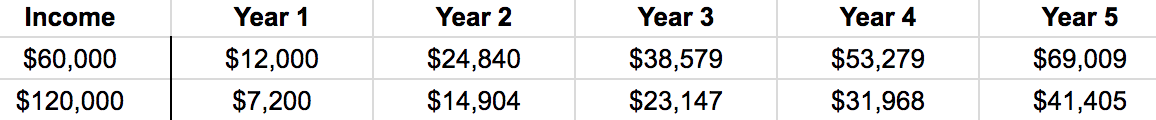

Somebody who is saving 20% of their income at $60,000 will become financially independent faster than somebody who is saving 6% of their $120,000 income. In the chart below, you can see the difference that savings rate makes over 5 years if invested in the stock market.

By raising your savings rate, you are not only going to be saving more money, but you’ll also be reducing your consumption. This means that you need less money to live off of, and you will become financially independent more quickly than a person that consumes heavily.

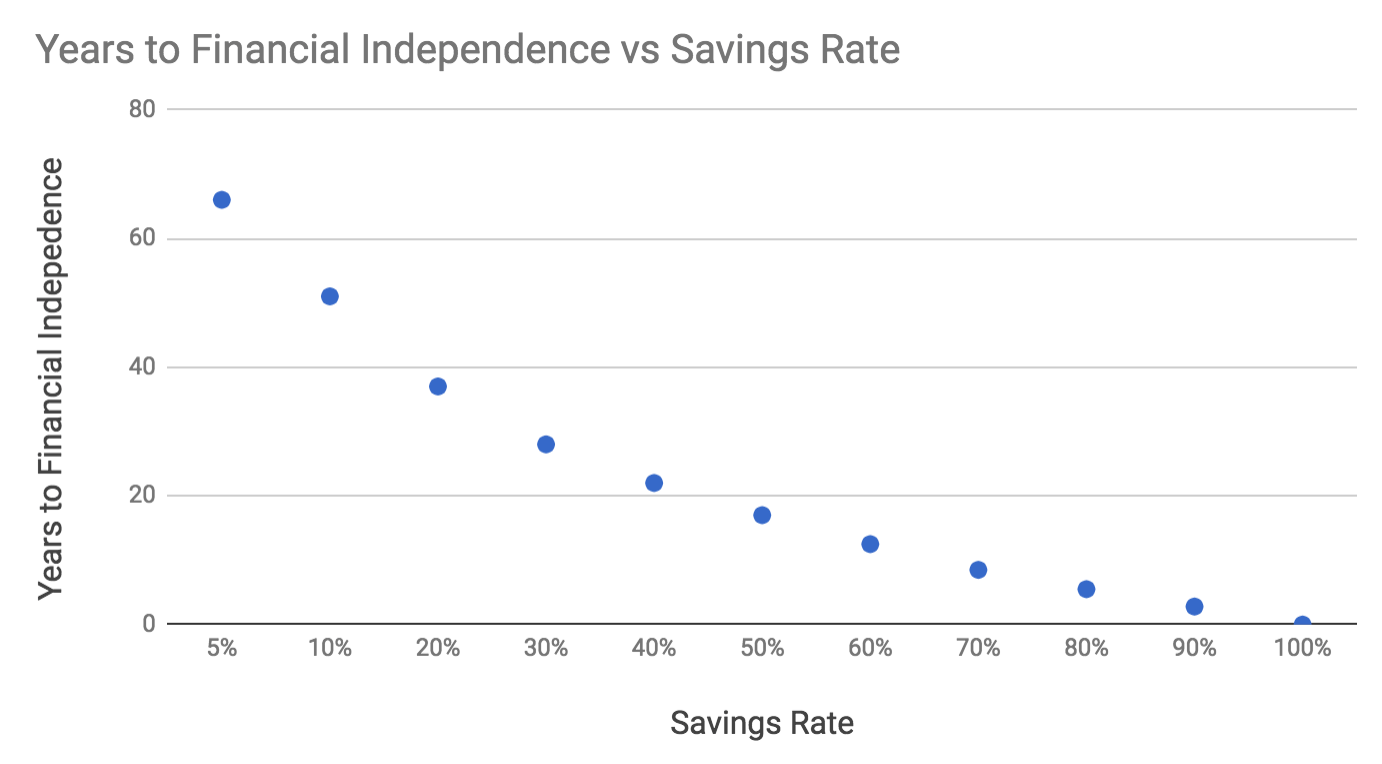

As the graph above shows, as you increase your savings rate, the time it takes to become financially independent decreases. When you accumulate wealth through savings, the growth and dividends of invested money begins to increase. The chart’s data estimates a conservative 5% after inflation average yearly return.

You’ll notice one important thing – the graph above does not show income, only savings rate. That’s because the only thing that matters is the savings rate. The ratio of your savings to your expenses is what determines your financial security.

Tools for Reducing Spending

Taking control of your spending is a powerful feeling. You’ll increase your savings, build more financial security, and you’ll likely feel better knowing that you are in control of your financial life.

While there is not one single solution for reducing spending, the number one thing that I always recommend is to do a budget. Tell your money where to go. While it might sound like more work, doing a budget frees you up to know where and how much money you can safely spend.

After a budget is in place, learn to live a debt free life. By no longer allowing yourself to use debt, you are limited to only spend money that you have in cold. hard. cash. Research shows you are likely to spend less money if you don’t use debt.

And finally, change your view on consumption. Realize that consuming more does not make your life better. Save and invest your hard earned money, and then spend your money with intention on items or experiences that align with your personal core values.

I been holding to this saying since I’m in college. I think it’s my literature teacher, I wish I remember his name. That’s around late 80’s.

Good stuff! It’s a timeless way of thinking that works regardless of the current economic environment.

Cold hard facts