Four years ago we made a financial decision that has had profound positive impacts on our life. That decision has allowed us to eliminate our debt, build wealth, and comfortably start a family. What’d we do? Started budgeting.

I would freak out if I had somebody telling me how much money I was supposed to spend on groceries.

I realize that not everybody shares my view on budgeting. My friend who recently said the quote above views a budget as something that would be constricting, and stressful. She is not alone, and for many people who have not successfully done a real budget, it’s not an appealing way of living. But just like healthy eating or exercise habits, once you get going on a budgeting plan, you’ll find that it actually helps you lead a more simple and stress-free life.

How to Budget

While there are many ways to do a household budget, my favorite, and the most simple, is to do a zero-based budget, using the money that is already in your possession. What does that mean? Simply give every dollar that you have a job. It’s called “zero-based” because every time you get paid, you keep budgeting the money you have until there is zero dollars left to budget.

A zero-based budget leaves you with a simple equation:

Budgeted Amount – Spent Amount = Available Amount.

Your available amount should always equal the amount of money in your bank account. As you get new money, you budget it.

By assigning the money that you have to jobs, you are in total control of your money. Which, I will remind you, is earned by your hard work! This sense of control will also make your life more simple, as you no longer play the mental game of, “do I have enough money for this?” Additionally, by actively assigning financial priorities, you are ensuring that you are going to make progress in your financial life.

An Example Budget

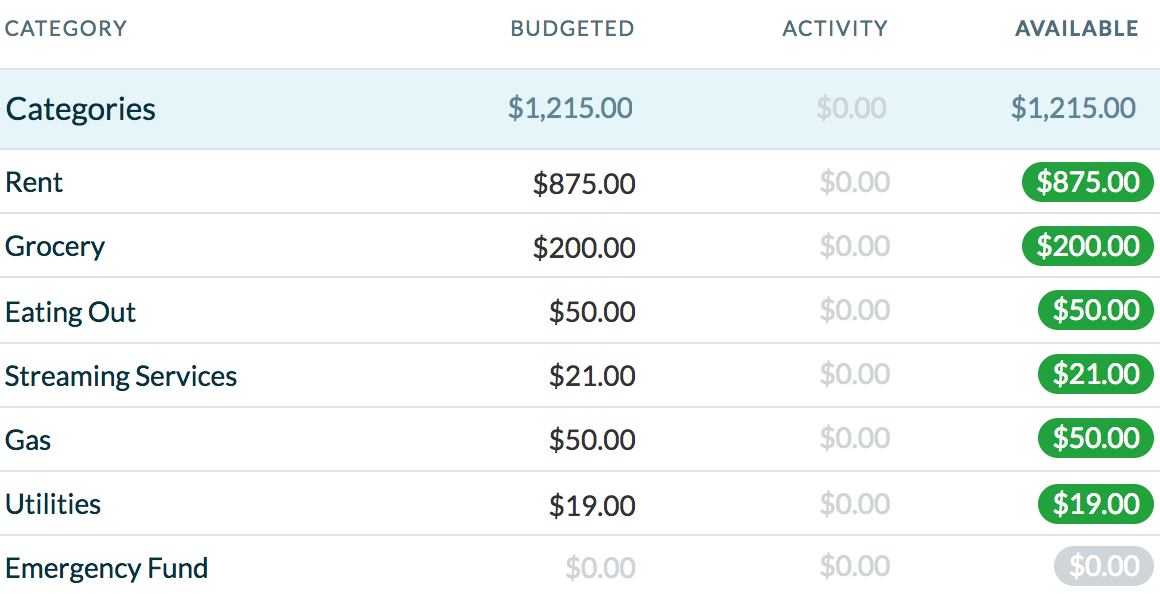

Here is an example of what doing a simple budget might look like. Our friend Sarah has $1,215 available in her bank account. She doesn’t have enough money to pay for all of her month’s expenses yet, so she will budget the money she has for the most upcoming expenses until her next paycheck. Looking forward at her upcoming expenses, she assigns they money she does have into her budget categories (you’d likely have more).

She’s done! She’s budgeted all of the money she has in her account. You can see that her available amount of money between all of her budget categories equals the amount of money in her bank. A zero-based budget.

You can also see that she didn’t have enough money to budget anything towards savings or her emergency fund. It’s also likely that her Utilities, Grocery and Eating Out budgets won’t last the whole month either. That’s okay, she can budget more money towards those categories when she gets paid next.

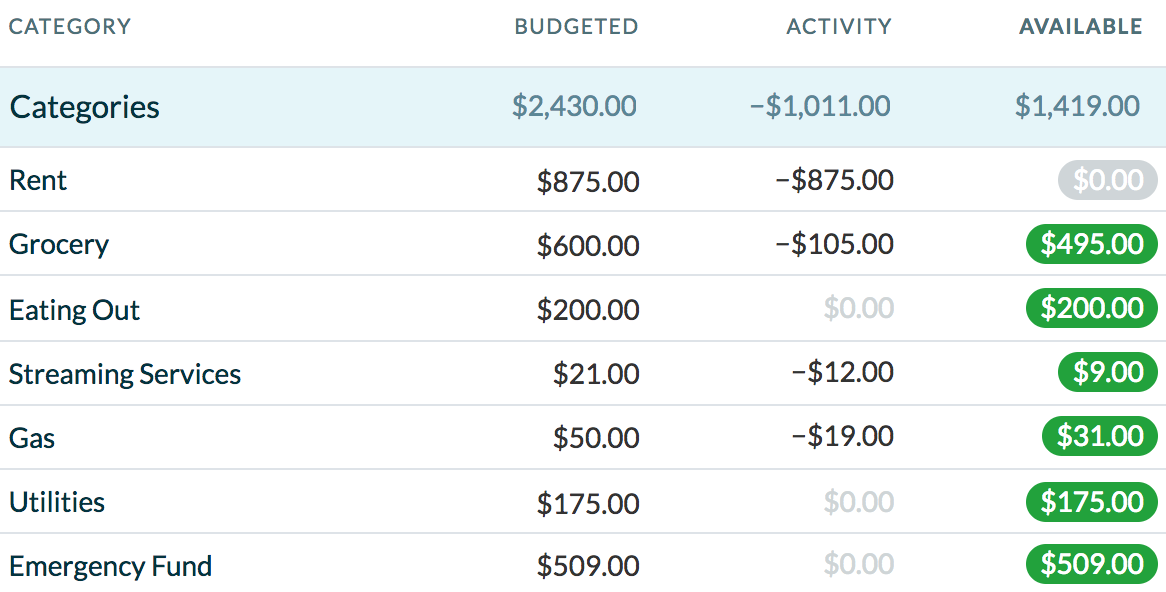

Fast forward two weeks. Here might be an example of how she budgets her next paycheck of $1,215 that month. In the meantime, she has also paid rent, bought some groceries, filled her gas tank, and paid her Netfix bill.

Nice job Sarah! You can see that her budgeted amount is equal to all of the money she’s made, and that her available amount is equal to what’s left in her bank.

Now she knows that all of the money in her bank account is assigned a job, as well as she has a good amount of savings for the future. Once she builds up enough savings, she should be able to break the paycheck-to-paycheck cycle, by using her savings to budget out entire months expenses all at once.

Simple Budgeting Tools

To make the budgeting process even more simple, there is a large amount of existing tools out there that streamline the process. I highly recommend you use a tool to budget with.

My favorite tool for budgeting is YNAB (screenshots above). It stands for You Need a Budget, and it’s a great digital budgeting tool with a mobile app and desktop version. It’s a zero-based budgeting tool that allows you to easily track the money you have, and the category balances for each area. YNAB also has excellent training resources to help you get started.

For those who prefer to use cash, you can use what’s called the envelope system. The concept is to pull out the budgeted amount of money in cash for each category, and put them in a labeled envelope. This will allow you to visually see how much food, going out, clothing, etc, money you have left budgeted.

Happy budgeting!

I’ve never thought of assigning jobs to my money. Thank you for this refreshing perspective!

Sure thing! You work for your money… make it work for you!